MXN Getting Closer to Support

July 10, 2020

HSI Technical Analysis

July 13, 2020

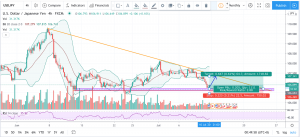

USDJPY CHART PRICE – ETHMXN DAILY

From the 4 hour chart, a clear two-months bearish triangle pattern can be identified on USDJPY. The price has been descending crawling on the lower band of the Bollinger Band. However, it has stopped at 106, and buying power has tried to stop the downtrend and push up the price from the lower bound of the triangle pattern, which is the support line. The Bollinger band’s width has started to decrease from its expansion, indicating that the slow down of its great volatility and also the price is likely to tend to rebound.

As can be seen from the Relative Strength Index, the USDJPY has reached a low oversold level of 30%, then has gone up a few points in today’s trading session as the pair had small gains. This shows the energy of continued decline is slightly insufficient, and the buying power is pushing up and trying to stop the price from breaking up the support level.

I expect the USDJPY to go up and retest the resistance level at 107. However, if the price continues to drop below the price of 106.5, it will break out the support level and continue its downward trend.

The upper resistance level we need to pay attention to is 107.

The lower support level we need to pay attention to is 106.5.

This post does not provide Financial Advice for traders, its merely purpose is education, use all the information available from different Analysts and build your own strategy, trading is not for everyone, you should only trade with money you can afford to lose, past performance is not an indicator of future results.