London, New York and Tokyo Sessions

Major Trading Sessions

Although the forex market is a decentralized market, in which there is no physical exchange of assets, and works 24 hours, it doesn’t mean that the market is always active and liquid. During the times when the market is inactive, it’s hard for traders to obtain profits. So traders should know the period of time that matches the primary daytime trading hours for a given locale, also known as Trading Session.

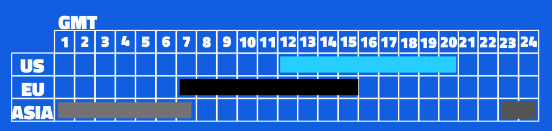

A Trading Session is a period of time when trading is open for a specific asset and location. The forex market main trading sessions are: the Tokyo (Asian) session, the European session, and the US session. In the image below you can see the hours for each session.

The actual open and close times are based on local business hours, with most business hours starting somewhere between 7-9 AM local time.

It’s important to mention that between each forex trading session, there is a period of time where two sessions are open at the same time. Obviously, those are the busiest trading hours, since there is more volume in the market.

Asian Session

The Asian session is also known as the Tokyo session, since the city is the Asia financial market capital and the yen is the third most traded country in the world. Hong Kong and Singapore markets also heavily impact this session.

This session starts at 12:00 AM GMT and mostly works while European and US markets are still closed. Most trades are led by commercial companies, exports and central banks.

The Tokyo session sets the mood for the following sessions. Its opening is also influenced by what happened during New York session closure.

The Asian session is often avoided due to its low liquidity and volatility, so traders have to wait longer to turn a trade into profit.

Key Characteristics of Asian Session

Liquidity - Very thin liquidity mainly in non-Asian currency pairs such as EUR/USD, GBP/USD and EUR/GBP, it means the prices of these assets don’t exhibit price movements as abrupt as Asian pairs.

Volatility - Due to the low liquidity, traders shouldn’t expect to see large fluctuations in price over the Asian Session, which usually leads to a more favourable trade execution, in other words, slippage is less likely to occur.

Clear Trading levels - Also influenced by the low liquidity, most pairs will follow certain trading ranges, which helps traders to identify levels of support and resistance.

Risk Management - Trades are also easily managed during this session due to the low volatility, since the market movements don’t oscillate as much, allowing traders to better analyze the risks and opportunities.

Trade Opportunities at Breakout - The last hour of the Asian session overlaps with European session opening, which increases the liquidity available in the markets and consequently benefits potential breakouts strategies during this time due to the sharp price movements.

Best Pairs to Trade During Asian Session

European Trading Session starts at 7am GMT. Although there are many financial centers in Europe, London has always been the financial capital due to its location.

London is considered the Forex capital of the world, since over 30% of all the forex transactions happen there. The European session happens between two major sessions, consequently this session usually exhibits lower spreads and higher liquidity.

3 Key Characteristics of European Session

1. High Volatility

The London session is the most volatile session of the day due to the high number of trades happening at this time. As price flows start increasing, trades can use it in their advantage to potential breakout trades, since support and resistance levels may be broken much more effectively than it would during the Asian session.

When speculating and trading breakouts, traders can benefit from the large price movement that will continue repeating for a certain amount of time to define entry and exit points for trades.

Overlaps

The London session overlaps with the Asian Session for an hour when it’s about to open and it also overlaps with the US session for 4 hours. When the US and European session crossovers, between 13:00 PM to 17:00 PM GMT, traders can find the period of the time with the highest liquidity, quick movements of prices and narrowest spreads in the day.

High Liquidity Levels

Liquidity levels are extremely high during the London session, since it includes a number of key economic and commercial markets. Additionally, the high volume of trades decreases the spreads on most currency pairs, mainly on majors, lowering the costs of opening positions during this time.

Best Pairs to Trade during European Session

The major pairs, such as USD/JPY, EUR/USD, GBP/USD and USD/CHF are responsible for most trades that take place during this session, mainly due to the great amount of transactions that provides lower trading costs. However, almost any pair can be traded due to the high liquidity of this session.

Major pairs are also heavily impacted by the Euro zone countries and UK news reports and economic data that are released during the London session.

US Session

The US session, also known as New York session, starts at 13:00 PM GMT, when the financial centers in London are still open and running. This session accounts for 16% of all daily forex transactions and it’s the second most important trading session. Most economic reports are released during this period of time.

The New York Session opening overlaps the European Session. During this time traders can experience the highest liquidity in the market sessions.

Economic news related to the US, Mexico, Canada and other South American countries is usually released in the morning, this translates as a lot of market movements. Any pairs involving the U.S Dollar are usually very volatile during the New York session, as foreign investors need to exchange their domestic currency for U.S. dollars.

When the London session closes, volatility and liquidity tends to decrease dramatically. Especially on Friday nights, when other financial centers are already closed for the weekend.

Trading During Overlap

When the London and US session crossover, there is an overflow of liquidity coming from the biggest financial centers in the world, consequently sharp and fast price movements can be noticed.

EUR/USD usually reach high average hourly moves during the overlap, which can be an opportunity for traders to use breakout strategies. This strategy is based on the idea that the market is experiencing a strong movement in a particular direction, however at an expected price level, the market expects to break through out of the support or resistance level.

Trading During the Second Half of US Session

The second part of the US session, when the European markets have already closed, usually exhibit low liquidity and volatility, making it harder to profit. Therefore, alternative trading strategies are usually used for traders, for example, trade range with price action.

The range trading strategy goal is basically identifying support and resistance areas, also called overbought and oversold areas, and buying the currency pair at support area or shorting the pair at the overbought area.

The reason behind this trading strategy is that it is harder to break out support and resistance levels when the volatility is low. The price tends to oscillate between a range.

Best Pairs to Trade During U.S Session

The best currency pairs to trade during the U.S session are usually majors like EUR/USD, GBP/USD, USD/CAD, EUR/JPY, GBP/JPY and USD/CHF, since most of them range 100 pips during this time period, specially during the European and US sessions overlap.

The New York Session also highly affects the cross pairs, since U.S dollars are indirectly involved in the cross pairs transactions.